In the Middle of My Own Storm

Here’s a question for you: Do you know the Joker who juggles 3 balls in his hands? Have…

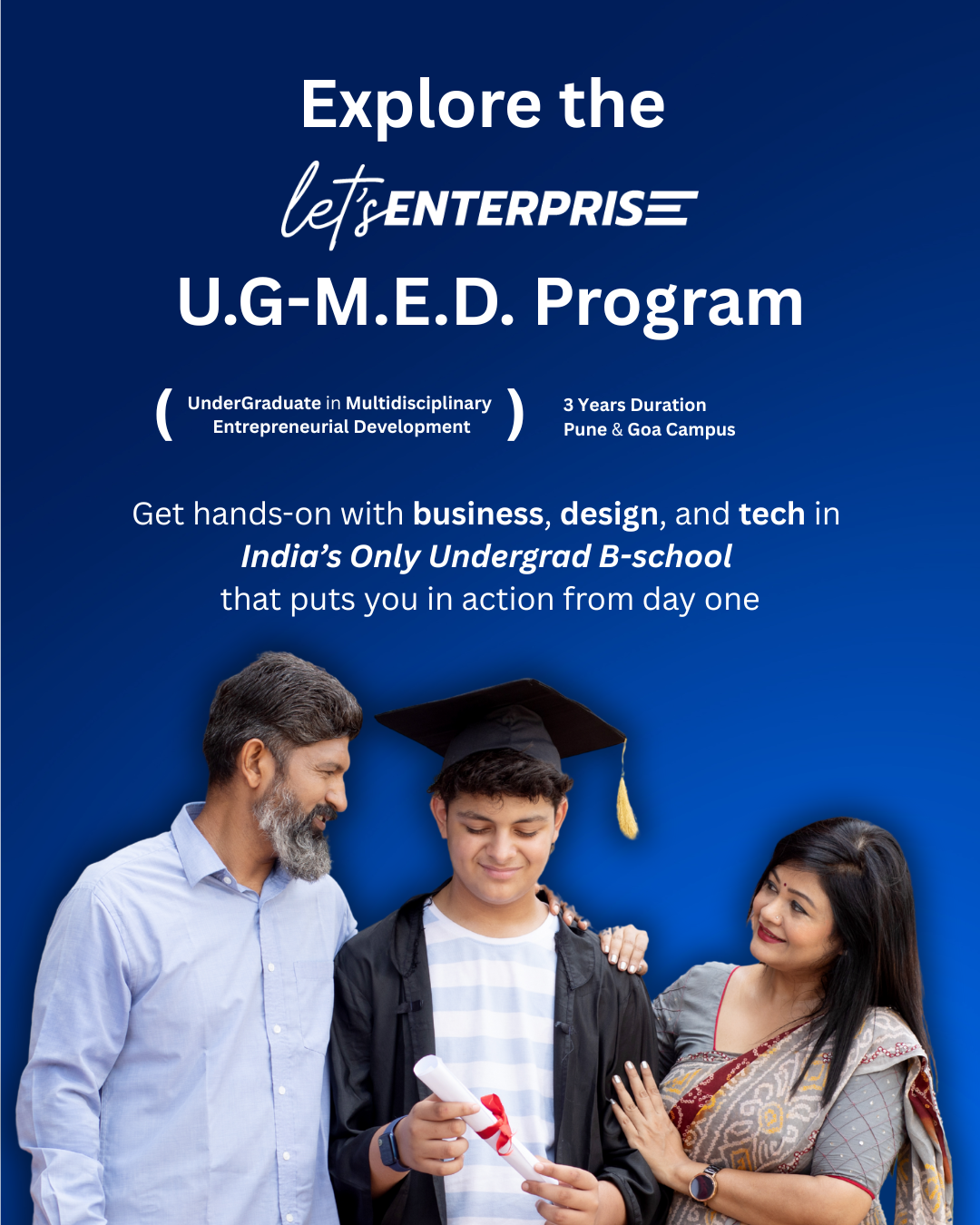

Let's Enterprise is a pioneering educational institution that empowers students with hands-on business skills through its unique UG-M.E.D. program. With campuses in Pune and Goa, it bridges the gap between traditional learning and real-world experience, shaping the future of tomorrow's entrepreneurs.

Discover how our first-year students are actively engaging in real-world business projects, guided by facilitator Sharjeel Shaikh.