In the Middle of My Own Storm

Here’s a question for you: Do you know the Joker who juggles 3 balls in his hands? Have…

July 23, 2020

[dropcaps type=’square’ font_size=’80’ color=’#4a4a4a’ background_color=’#ffffff’ border_color=”]O[/dropcaps]n a fine Sunday evening, 14 year old me stumbled on my father deep in analysis and calculation. There were bank statements and passbooks scattered all over his desk. I was curious about why he was wasting his time when he could easily hire an accountant to deal with this… At that moment he gave me one of the important teachings of personal finance, he said, a person should know about his financial transactions well so that he can be aware of his financial status. One should not rely on anybody and be well versed with playing with numbers.

The moment sparked a passion for financial independence. The first step towards this was opening a bank account for myself. I started my research on the internet and found out how to open a bank account. Back then, the closest bank was SBI; a government bank. Even my parents avoided government banks due to the excessive red tape but 14 year old me was determined and unstoppable. One day after school, I went to the bank to request an account opening form. The employee of the bank asked me to go to another counter and I was redirected multiple times because nobody took me seriously. Eventually, when I filled out the form, I was asked to deposit the minimum balance of Rs 2000 and bring back some documents the next day. I said “Ok”. The next day, I got all the documents along with the money that I had saved from my pocket-money to process my account opening. This was the first step toward my financial freedom. My very own savings account!

After that initial step, I started taking more baby steps towards financial freedom. Just a couple of weeks back, I had a conversation with my friend Marc from Switzerland. We discussed how our generation plans their finances. We realized that even though we were in two different countries, our generation was facing similar problems; many people from our generation hadn’t planned for this pandemic. These people were now either stretched to their financial limits or were finding themselves broke.

After that initial step, I started taking more baby steps towards financial freedom. Just a couple of weeks back, I had a conversation with my friend Marc from Switzerland. We discussed how our generation plans their finances. We realized that even though we were in two different countries, our generation was facing similar problems; many people from our generation hadn’t planned for this pandemic. These people were now either stretched to their financial limits or were finding themselves broke.

A concept we thought about was ‘minimalism’. Millennials are increasingly incorporating the idea of ‘less is more’ into their daily lifestyle. Today’s minimalistic youth are focused on sustainability, savings, and investment to secure their financial future. Here are some important realizations stemming from our conversation:

This is money accumulated equivalent to the income of 3 months or expense of 6 months of an individual for him or his family. Personally, I do follow this and it helped me in this current breakdown situation to match with my expenses. This is one of the foundational pillars of financial freedom.

This is another aspect to take into consideration, we need to save money to build financial freedom & resiliency. It should be flexible to help you out when needed. You must take care because idle savings don’t work. It must be accompanied by investment, it should beat out the inflation, and it should make you resilient.

Apart from developing an emergency fund and savings, there are many small habits we can develop for financial independence:

Plan your needs carefully! Look around yourself and find the basic needs, then declutter the things that you don’t really require. Do simple calculations and list down your expenses, surprisingly you would find that many small expenses add up and drain your pockets.

We can use the “Less is more” philosophy which means spending less while trying to enjoy little things and focusing on the quality of products rather than the quantity. This is a sustainable way to have long-lasting products or reusable products.

Risk pooling is an alternative and cool way to reduce risk for a particular individual. It involves a strong community and a network of people that can support you when you need help and a crowdfunding platform where everyone contributes as per their own will.

In the past three months, I have tried my best to incorporate these habits and principles in my own life. I made small changes that have led to big differences. For example, I have survived well without my Amazon prime account. Before the pandemic, I used it a lot but soon I realized that ‘less is more’ and I really didn’t need fast and free shipping. This small change has contributed towards keeping me financially resilient during these tough times as well as contributed towards sustainability for the planet. I hope to continue to critically examine my daily habits to separate needs from wants and adopt minimalism within all aspects of my life.

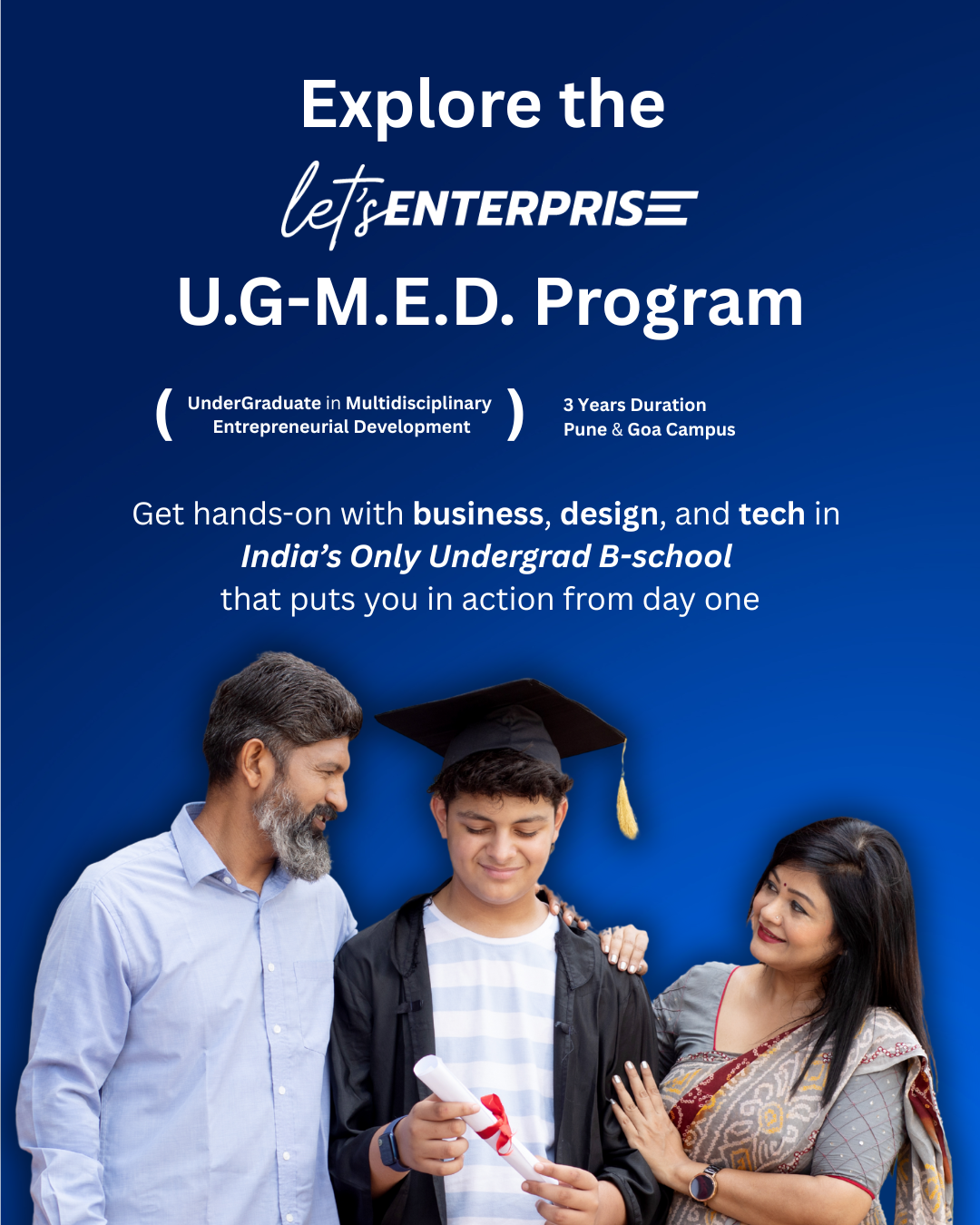

Let's Enterprise is a pioneering educational institution that empowers students with hands-on business skills through its unique UG-M.E.D. program. With campuses in Pune and Goa, it bridges the gap between traditional learning and real-world experience, shaping the future of tomorrow's entrepreneurs.

Discover how our first-year students are actively engaging in real-world business projects, guided by facilitator Sharjeel Shaikh.